Common sense is that the market timing doesn’t matter much, or at least it should give very similar result if the overall strategy follows same idea. However, the difference is quite stunning.

The winning ratio (profit/loss stats) and day win ratio (strategy/benchmark) are close, beta is similar.

| Measure | CrossAbove | Ema5>Ema20 |

| Winning Ratio | 0.395 | 0.387 |

| Day Win Ratio | 0.497 | 0.478 |

| Beta | 0.38 | 0.374 |

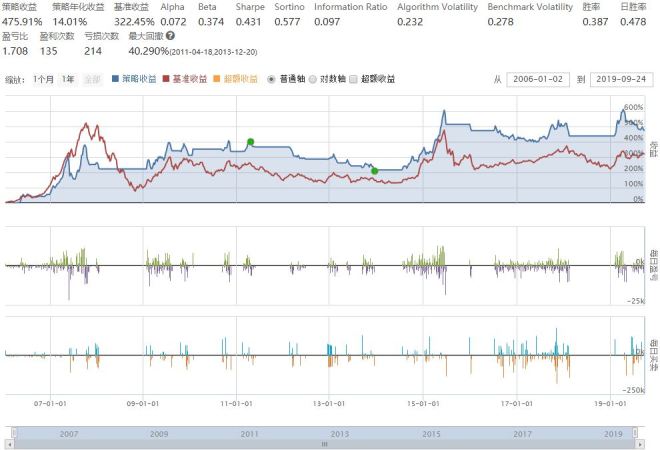

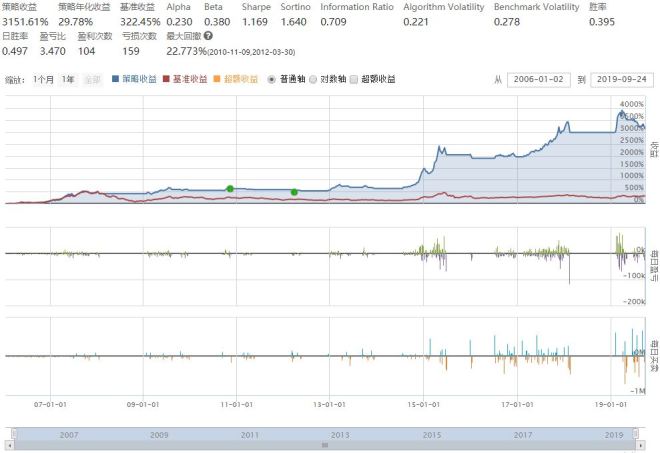

The difference lies on, MDD and Profit Factor.

| Measure | CrossAbove | Ema5>Ema20 |

| MDD | 23% | 40% |

| Profit Factor | 3.47 | 1.7 |

| Alpha | 0.23 | 0.072 |

1 MDD is 23% vs 40%

With market timing, the max draw down is considerable lower.

2 Profit Factor is 3.47 vs 1.7

Profit/loss ratio is improved drastically when entering on timing.

Alpha

Alpha is improved when entering with crossabove signal. So can I say that the market timing signal actually generates alpha?

Entry on EMA5 CrossesAbove EMA20

Entry On EMA(5)>EMA(20) Rank By P/E: