I’ve done backtest on a model that references to ideas from both Elder’s triple screen and MTS’ MACD.

Daily Bar Dimension:

- DEA>0 (there’re ideas for daily bar trend filter, e.g. DEA+HISTOROC, DEA+HISTO)

Hourly Bar Dimension:

- price closes above trend

- trend moves up

- dea>0

Exit Filter:

- dea<0 and histo<0

- or, price hits recent lows.

- or, price breaks under trend.

Entry Signal:

histo turns from negative to position to BUY.

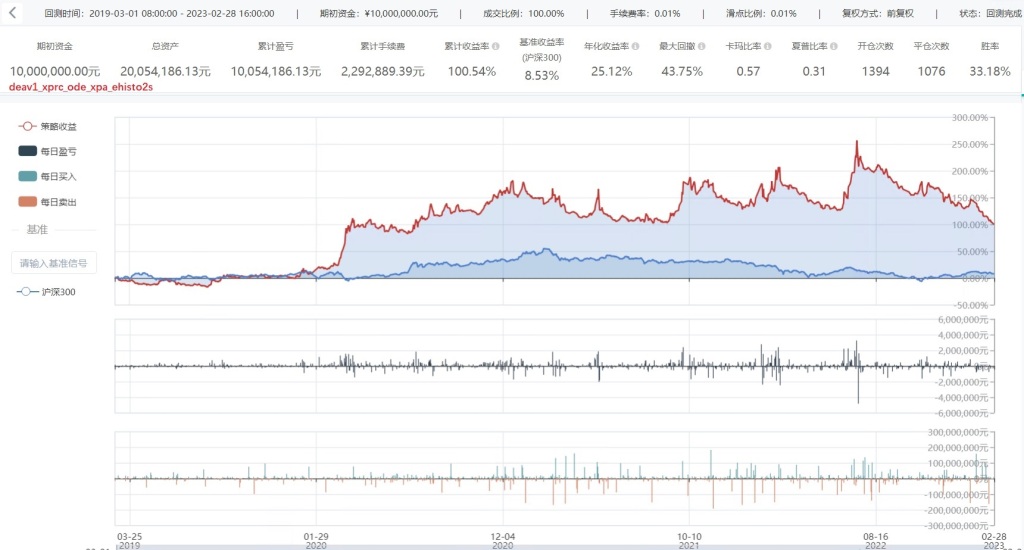

Backtest period from Mar2019 to Mar2023, with result as following:

Three types (deav1, deav2, dearc) of Daily Bar Dimension filters are tested, and performance measured based on Max Drawdown (MDD), Calmar, Sharpe ratio and winning ratio.

Two observations below:

-

Trend filter at daily dimension does not impact the performance much and the winning ratio is about the same.

-

Entry with 1sigma/2sigma at execution dimension matters a lot. Intuitively, entry signals at 2sigma will be much more than entry at 1sigma. However, overall winning ratio does not change much.

The following 2 charts compares the same model but one entries only at 1sigma and the other at 2sigma.

2 thoughts on “MACD With Triple Screen”