Volatility is an important statistical factor for technical analysis. For example, we’ll require volatility for sharpe ratio, sortino ratio and etc.

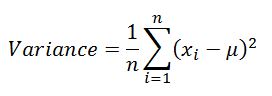

Typically, we compute the volatility using the following formula:

When implementing this into a computer program, there will be practical consideration. For example, computing the variance for stocks of n days will require lots of computation among other computation that the program requires to do; and sometimes a price for a stock is missing then how will this formula be adjusted to the missing price?

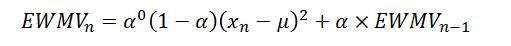

By using exponential decay, one can calculate the volatility efficiently. The variance is using 1/n for each deviation factors, while the EWMA will use decay factors to control the average.

Variance(t) = … + mu(t-3)^2*(1-lamda)*lamda^3 + mu(t-2)^2*(1-lamda)*lamda^2 + mu(t-1)^2*(1-lamda)*lamda^1 + mu(t)^2*(1-lamda)*lamda^0

using this expression, we can write the long term for sigma(t-1):

Variance(t-1)= … + mu(t-4)^2*(1-lamda)*lamda^3+ mu(t-3)^2*(1-lamda)*lamda^2 + mu(t-2)^2*(1-lamda)*lamda^1 + mu(t-1)^2*(1-lamda)*lamda^0

substitute this term to the first equitation:

Variance(t) = Variance(t-1)*lamda + mu(t)^2*(1-lamda)*lamda^0

=Variance(t-1)*lamda + mu(t)^2*(1-lamda)

If the variance is calculated daily, today’s variance can be computed using the previous day variance and today’s return.

Reference:

1. exponentially weighted moving average of volatility

http://www.investopedia.com/articles/07/ewma.asp

2. how to calculate historical volatility

http://www.investopedia.com/articles/06/historicalvolatility.asp

3. weighted moving average

https://en.wikipedia.org/wiki/Moving_average#Weighted_moving_average

https://en.wikipedia.org/wiki/Exponential_smoothing